AI is revolutionizing insurance, speeding up claims, improving underwriting, and reducing fraud. But with great power comes great responsibility. As AI-driven automation expands, insurers must address critical ethical concerns to maintain trust with policyholders and regulators.

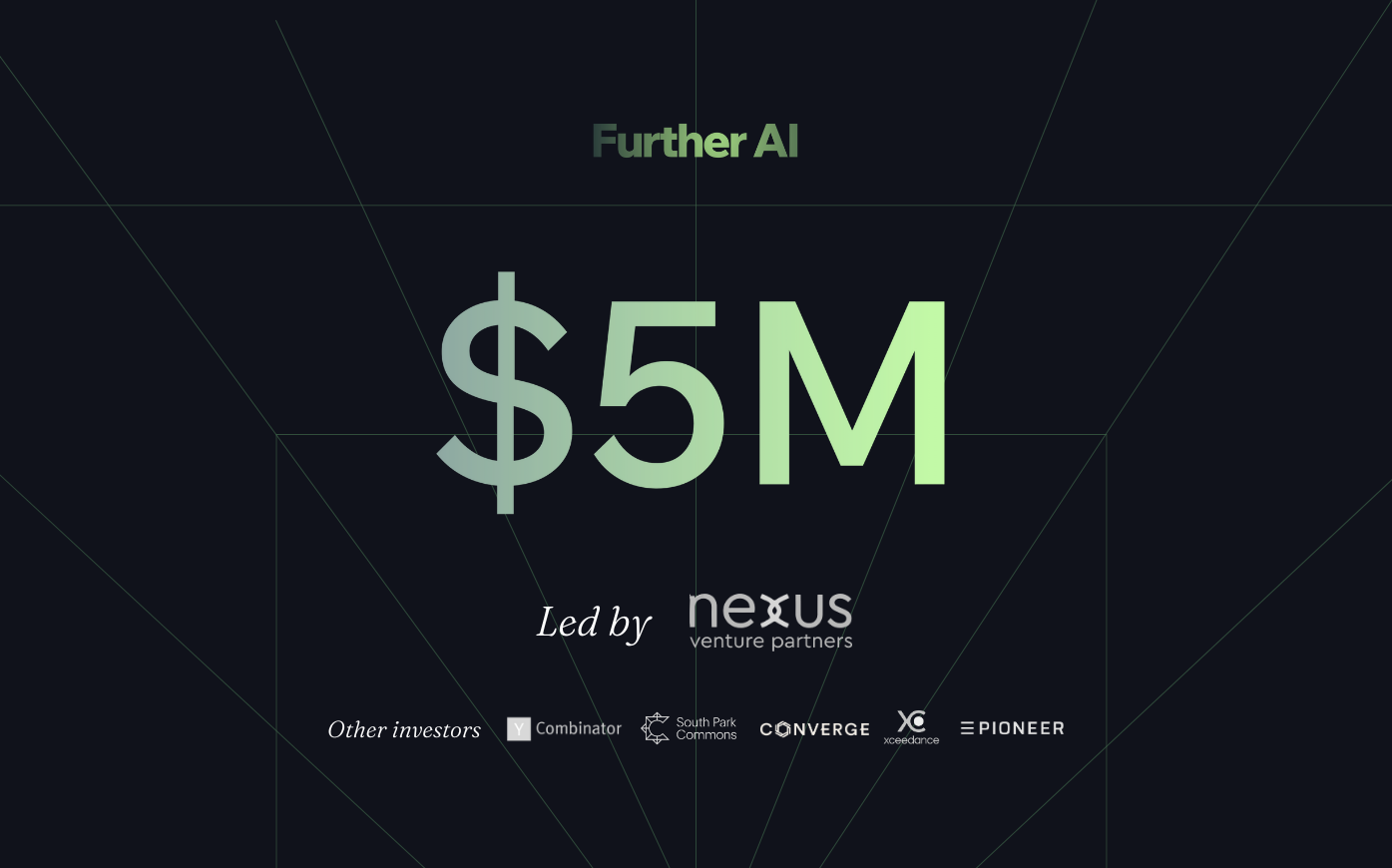

How can insurers balance efficiency with fairness? How do we ensure transparency in AI-driven decisions? At FurtherAI, we help insurers deploy AI responsibly, ensuring compliance, customer trust, and long-term sustainability. Let’s explore the ethical challenges of AI in insurance and how to address them.

The Key Ethical Challenges of AI in Insurance

1. AI Bias: Are We Making Fair Decisions?

One of the biggest concerns with AI is bias when machine learning models unintentionally discriminate against certain demographics. Bias can creep in through:

- Historical Data Issues: AI models trained on biased historical data may reinforce existing disparities.

- Opaque Algorithms: If insurers can’t explain AI-generated decisions, regulators and customers may question their fairness.

- Lack of Human Oversight: Over-reliance on automation can lead to unfair rejections or mispriced policies.

✅ Solution: Insurers must audit AI models regularly, implement fairness checks, and ensure human oversight in key decision-making processes.

2. Transparency: Do Customers Know How AI is Used?

Customers want to understand how their policies are priced and why claims are approved or denied. However, AI-driven underwriting and claims assessments often operate as 'black boxes,' leaving policyholders in the dark.

The Risk? Without clear explanations, policyholders may distrust AI-driven decisions and challenge insurers on fairness grounds.

✅ Solution: Insurers must provide explainable AI, where decisions can be broken down into understandable insights. Regulatory agencies are also pushing for AI transparency, making this an urgent priority.

3. Data Privacy: Who Owns and Controls the Data?

AI requires vast amounts of data to function effectively, but where does that data come from, and how is it protected? With increasing regulations like GDPR and CCPA, insurers must ensure:

- Data is collected ethically and with customer consent.

- Strict data protection measures are in place.

- AI doesn’t infringe on policyholder privacy.

✅ Solution: Insurers should adopt privacy-first AI strategies, anonymizing data where possible and giving customers control over their information.

4. The Role of AI in Claims & Fraud Detection: Where’s the Line?

AI is being used to detect fraudulent claims, saving insurers billions. However, some AI-driven fraud detection models risk over-flagging legitimate claims, leading to unfair denials and frustrated customers.

The Risk? If AI misidentifies legitimate claims as fraud, insurers face reputational damage and regulatory scrutiny.

✅ Solution: Fraud detection AI should be continuously refined and supplemented with human review to ensure accuracy and fairness.

The Regulatory Landscape: AI Compliance is Not Optional

Governments and regulators are watching AI developments closely. New laws are emerging to ensure ethical AI use in insurance, including:

- The EU AI Act: A strict framework defining acceptable AI applications in financial services.

- U.S. State Regulations: States like California are implementing AI accountability laws.

- Global Data Protection Laws: Privacy laws like GDPR and CCPA are tightening restrictions on AI data usage.

✅ Solution: Insurers must stay ahead of compliance requirements by proactively adopting ethical AI frameworks and ensuring alignment with emerging regulations.

Why Ethical AI is a Competitive Advantage for Insurers

Insurers who commit to ethical AI practices will: 🚀 Build trust with customers by ensuring fair, transparent decisions.

🚀 Stay ahead of regulations and avoid costly penalties.

🚀 Enhance brand reputation as a responsible, customer-centric insurer.

🚀 Improve long-term profitability by reducing AI-related disputes and maintaining policyholder loyalty.

How FurtherAI Ensures Ethical AI for Insurers

At FurtherAI, we help insurers implement AI with: ✅ Bias detection tools to ensure fair decision-making.

✅ Explainable AI models so insurers can provide clear policyholder insights.

✅ Data privacy safeguards that align with global regulations.

✅ AI compliance solutions to keep insurers ahead of evolving legal frameworks.

Conclusion: AI in Insurance Must Be Ethical to Succeed

AI is transforming insurance, but ethical concerns must be addressed head-on. Insurers that prioritize fairness, transparency, and compliance will thrive. Those that don’t risk losing trust, customers, and regulatory approval.

Are you ready to deploy AI responsibly? Contact FurtherAI today to learn how we help insurers build ethical, AI-powered solutions that drive growth while maintaining trust.

Ready to Go Further &

Transform Your Insurance Ops?

Reclaim your time for strategic work and let our AI Assistant handle the busywork. Schedule a demo to see how you can achieve more, faster.